Each month we take a graphical deep dive into the Antipodean housing markets.

Housing prices were little changed over January in Australia. Dwelling prices continued to decline in Sydney and Melbourne and growth has slowed in other capital cities. Sales volumes are down and listings are up.

The spectre of lower interest rates raises the possibility that the current softness in Australian housing prices will prove reasonably short-lived. Working in the other direction, however, is the waning support from the pandemic-era build-up in household deposits.

As we noted last month, there is a broad relationship between growth in real housing prices and real private demand, often with a lag because housing prices are one of the most interest-rate sensitive economic variables.

At face value, our expectation for a pick-up in private demand growth in Australia is consistent with the prior recovery in real housing price growth (due to lags).

If housing price weakness were to persist for an extended period - say, due to prices catching down to typical borrowing capacity - then we would expect the forecast recovery in private demand growth to peter out.

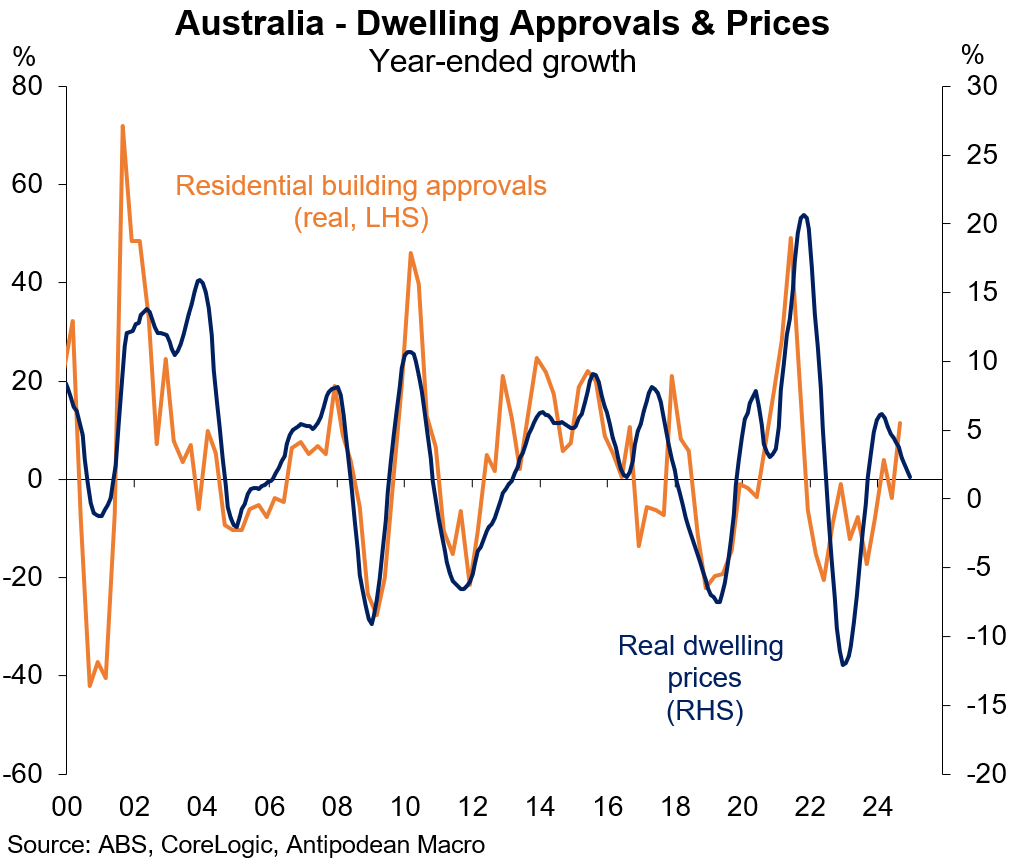

Adverse wealth effects would be expected to weigh on consumer spending growth and lower housing prices would disincentivise dwelling investment. The cycles for residential building and dwelling prices are very similar.

For now this is in the risk bucket.

Across the ditch in New Zealand, the effects of lower interest rates are starting to show up in housing demand. New housing finance has clearly strengthened, including for housing purchases and building. Monthly dwelling price growth has been volatile but prices appear to have stopped falling. Consents for new home building also appear to have stabilised following a significant decline.