Each month we take a graphical deep dive into the Antipodean housing markets.

Housing prices in Australia again rose modestly over March, though some of that is likely to be seasonal. Prices increased in nearly all capital cities and monthly growth has converged across regions. The number of homes listed for sale has dipped a little in recent months in response to the prior slowing in dwelling price growth.

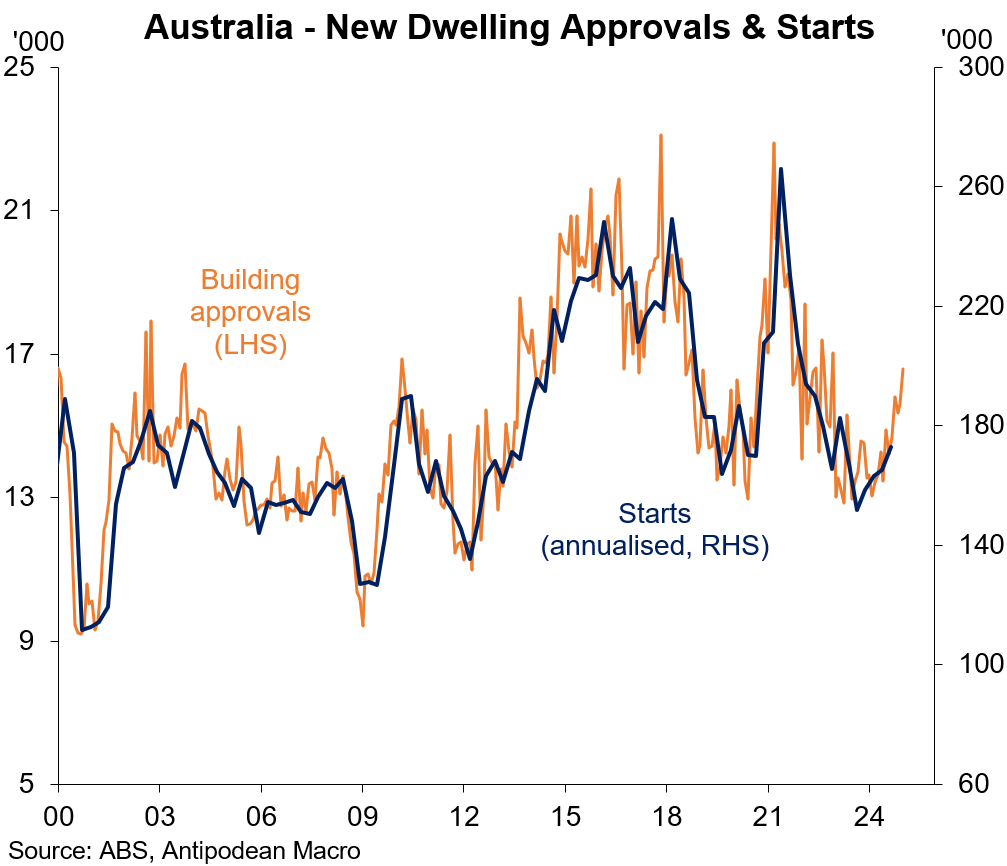

Encouragingly, the number of residential building approvals in Australia has picked up and actual dwelling starts have followed (as usual).

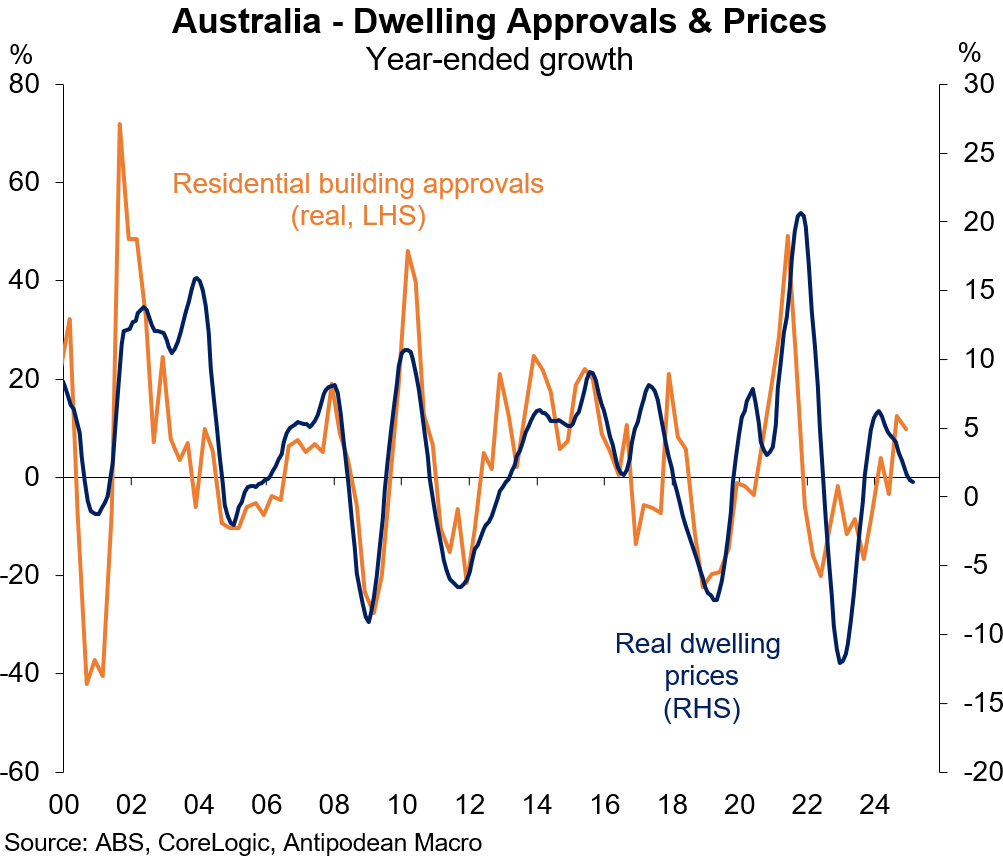

As has historically been the case, the pick-up in home building approvals has occurred against a backdrop of rising real dwelling prices. While the recent slowing in real dwelling price growth may be a near-term headwind to how quickly home building approvals continue to recover, anticipated interest rate cuts over the next 6-12 months should provide a tailwind to both price growth and building approvals.

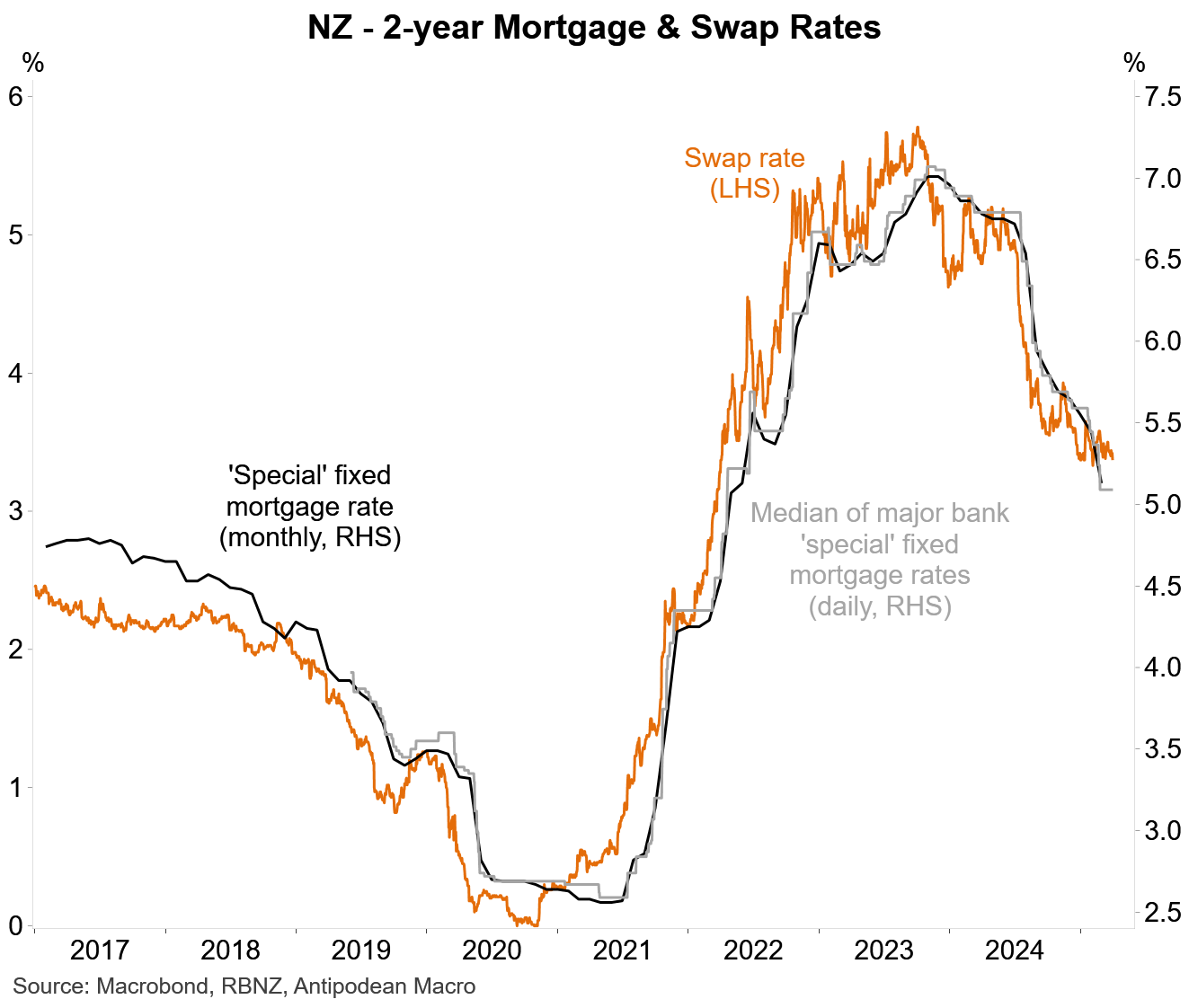

In New Zealand, only modest effects from sharply lower fixed mortgage interest rates are evident in housing demand. Housing prices have risen a little in recent months, though the stock of homes for sale reached a new cyclical high in March. The number of housing loan commitments, however, has continued to gradually increase.

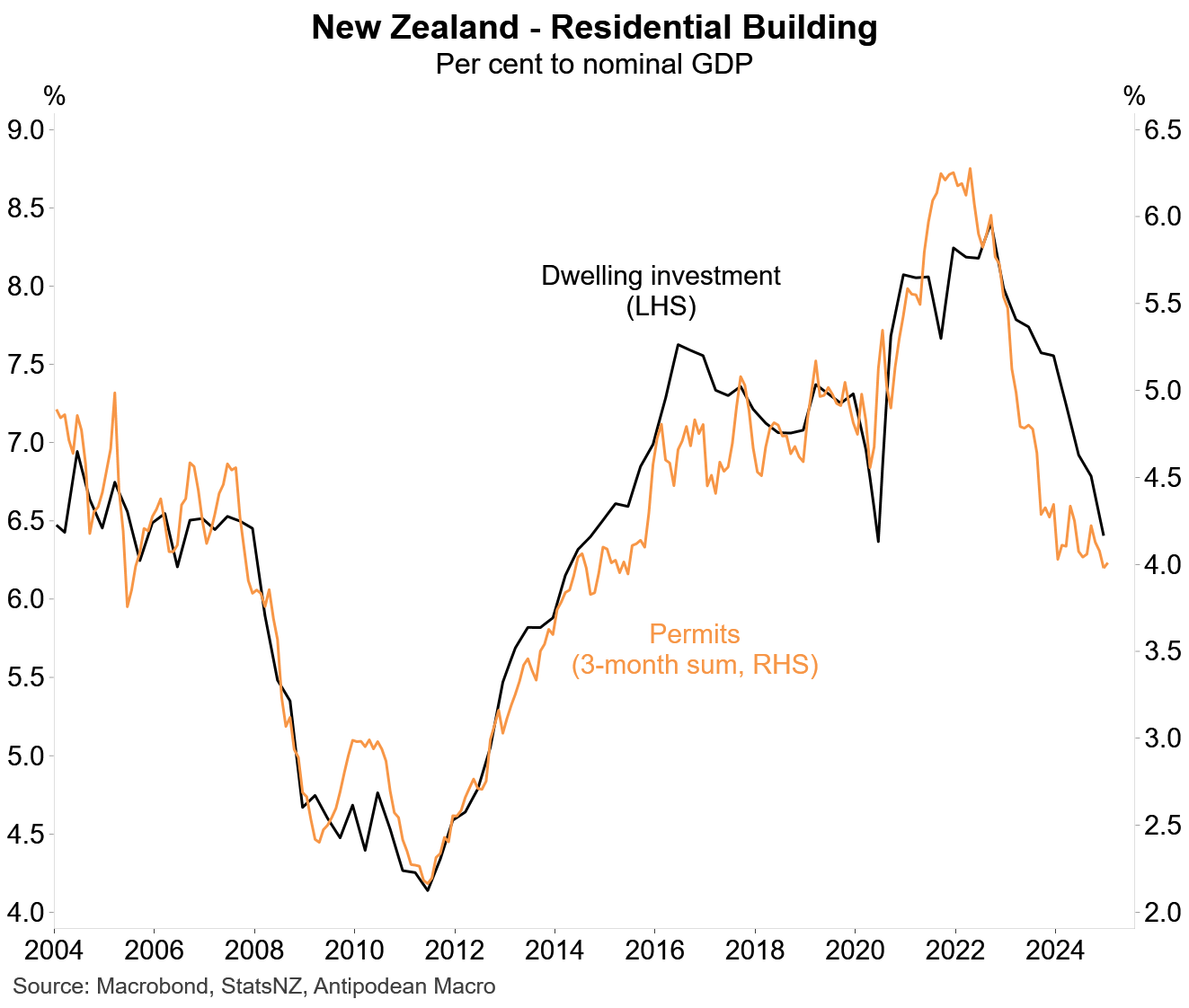

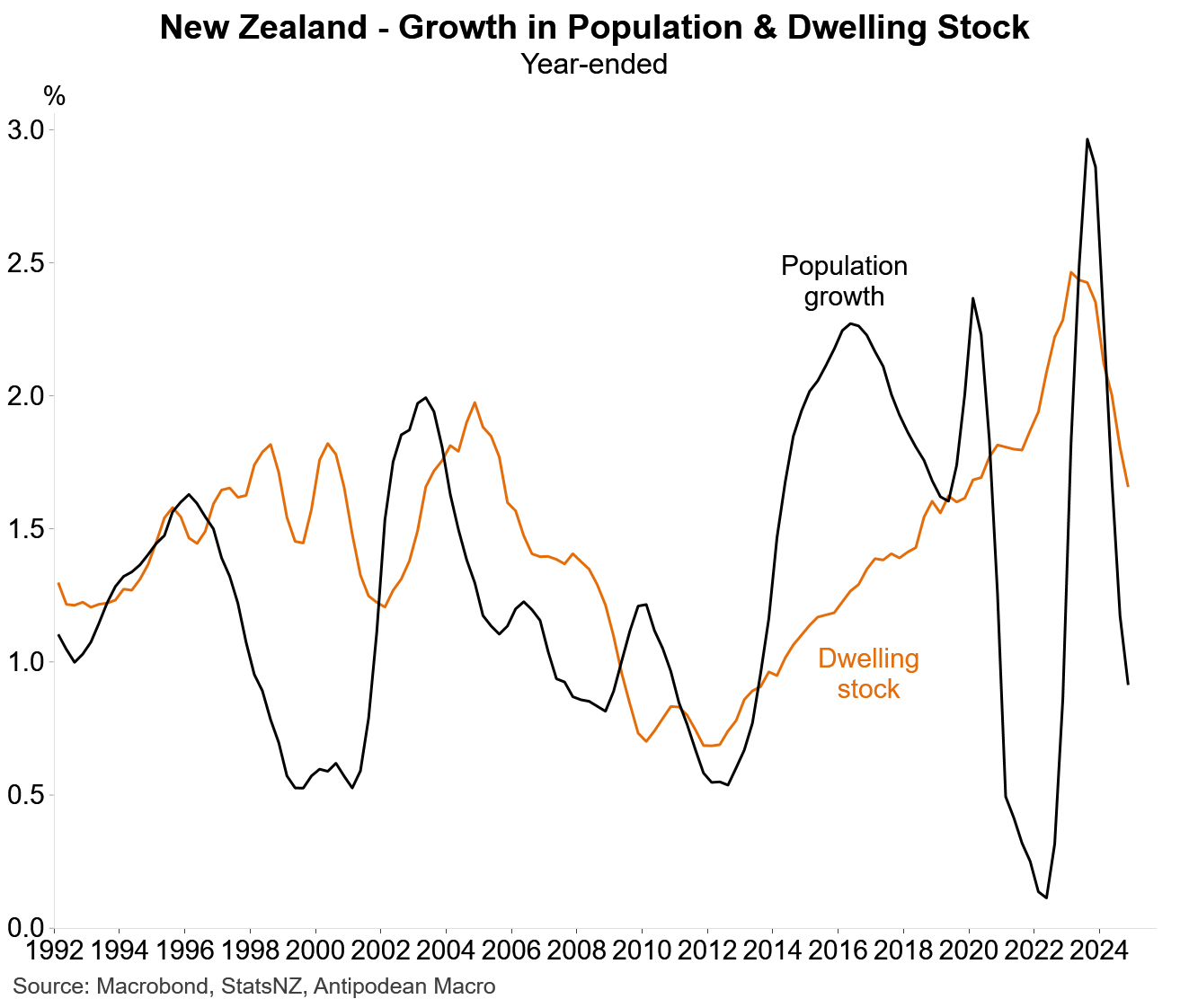

While lower interest rates can be expected to support a pick-up in residential building in New Zealand, there are few signs yet of it happening. The sharp slowing in population growth to be clearly below growth in the dwelling stock also reduces the need to build significantly more housing.