Antipodean Housing Deep Dive

How much a headwind from falling housing prices?

Each month we take a graphical deep dive into the Antipodean housing markets.

Housing prices fell slightly over December in Australia, led by solid declines in Sydney and Melbourne, which have continued into early January.

Australian housing prices have been pretty resilient to higher interest rates. Maybe that's another sign of monetary policy not being overly tight in Australia. Strong net immigration and the build-up in household savings during the pandemic are likely to have also played a role to offset the effect of lower borrowing capacity amid higher interest rates.

The reaction of housing prices (and the dwelling price-to-income ratio) to higher interest rates has been a bit different this time to the past (see shaded areas in chart).

But all tightening episodes have elicited somewhat different responses.

While real housing prices and the price-to-income ratio have risen over the past couple of years, they both remain below the peaks.

How much do housing prices matter for the broader economy?

There is a broad relationship between growth in real housing prices and real private demand, often with a lag. (Like most things, however, the pandemic played a bit of havoc with the relationship.)

It's not clear how strong the causality is here, with interest rates affecting both - it typically affects housing prices more quickly.

At face value, our expectation for a pick-up in private demand growth in Australia is consistent with the prior recovery in real housing price growth (due to lags).

If housing price weakness were to persist for an extended period - say, due to prices catching down to typical borrowing capacity - then we would expect the forecast recovery in private demand growth to peter out.

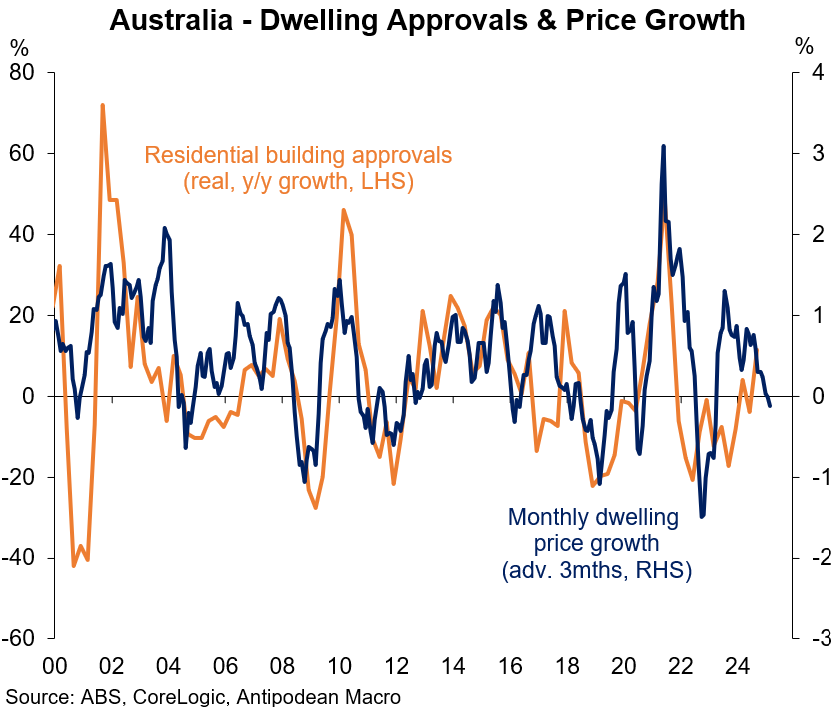

Adverse wealth effects would be expected to weigh on consumer spending growth and lower housing prices would disincentivise dwelling investment. The cycles for residential building and dwelling prices are very similar.

Of course, the RBA would not ignore persistent falls in housing prices if gauged to be a significant headwind to the broader economy. We expect the RBA Board to deliver modest policy easing in H1 this year (see here), and falling housing prices would, at the margin, make that decision a little easier.