A common word used by equity analysts to describe the Australian consumer through the current company reporting season has been “resilient”.

Share prices for several consumer-facing companies have performed well, in part because analysts’ pessimism hasn’t been borne out in company results. The S&P/ASX Consumer Discretionary index is at an all-time high.

Some consumer discretionary stocks have risen because of relatively positive updates on recent trading conditions and/or expectations of better trading conditions ahead.

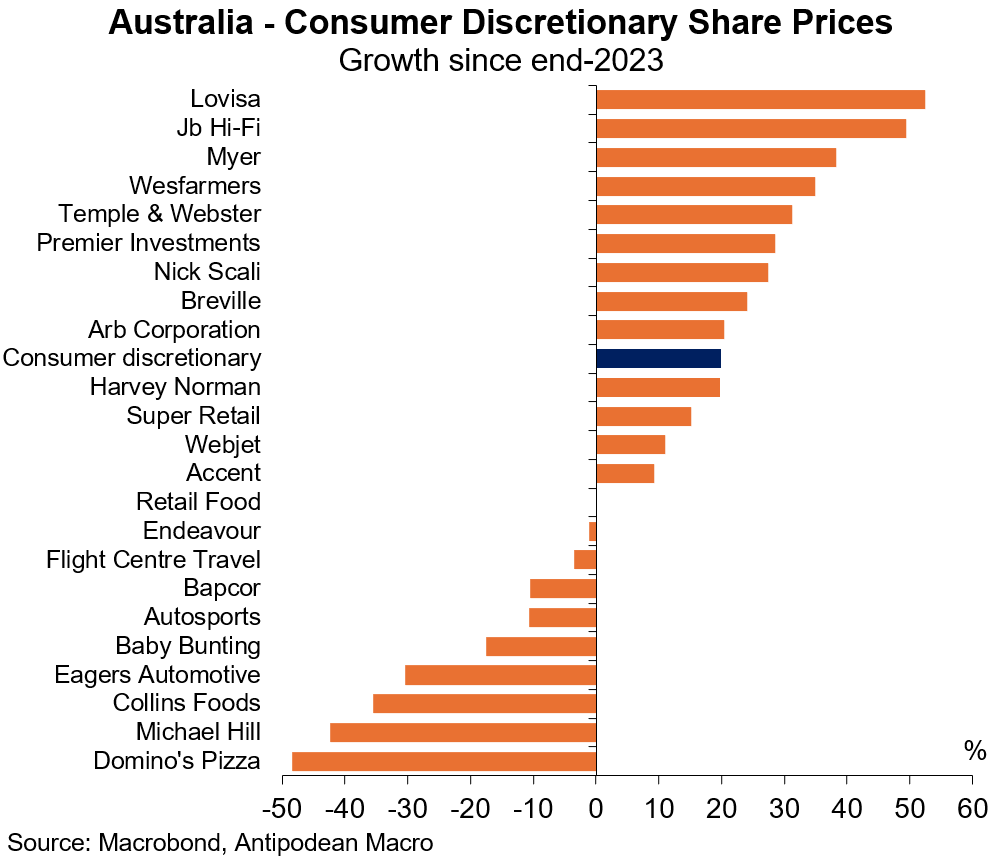

While the consumer discretionary share price index has risen by ~20% since end-2023, it has been a far from even performance across major stocks.

Let there be no doubt, consumption growth has been weak…

In what looks like a contrast, economists have been highlighting the weakness in (real) consumer spending growth in Australia for well over a year.

Growth in (real) household consumption in Australia has been well below the pre-pandemic decade average and consumer confidence in Australia remains relatively weak.

Keep reading with a 7-day free trial

Subscribe to Antipodean Macro Professional to keep reading this post and get 7 days of free access to the full post archives.