Australia’s August CPI indicator will be released this Wednesday.

This release can be used in conjunction with the July CPI to nowcast a good estimate of the Q3 CPI, including on an underlying basis. The RBA’s August SMP had pencilled in a trimmed mean inflation forecast of a little more than +0.6% q/q for Q3.

Around 68% of the CPI basket by weight is price updated in August, with several services categories measured in the mid-month of the quarter. Notably, domestic market services categories with a combined CPI weight of ~14% are updated in August (compared with ~2% in July).

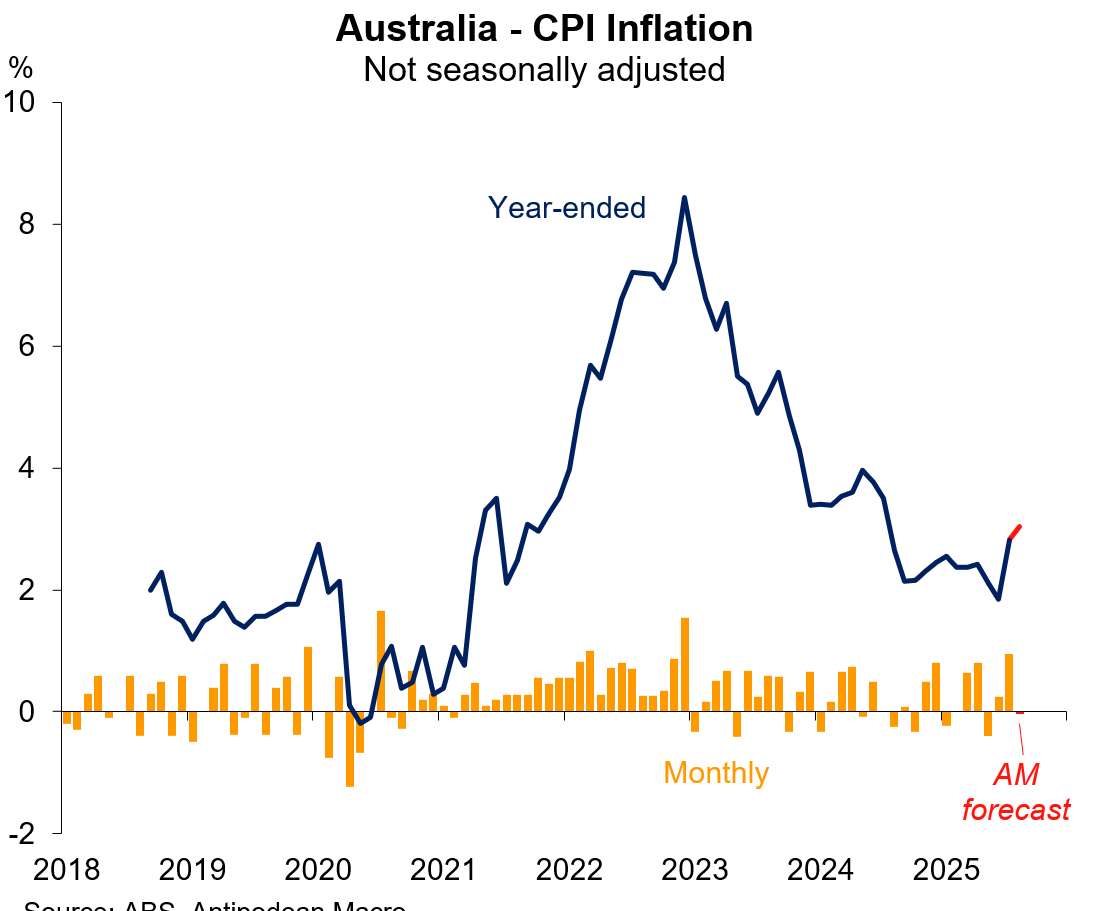

We expect year-ended headline inflation to have picked up a little to +3% y/y in August from +2.8% y/y in July. In monthly terms, we expect the CPI to have fallen slightly. There is considerably uncertainty around this nowcast given surprisingly large increases in travel and electricity prices in July and the potential for surprises to the downside in August.

The 13% m/m rise in electricity prices in July was because of increases in underlying prices and the fact that the $75 quarterly federal government rebate was not available for households in NSW and the ACT. (These regions account for ~44% of electricity by weight in the CPI.) Those households will have started to receive the rebate in August, though households whose billing cycle is in July 2025 will instead receive two instalments in October 2025. We have pencilled in a 3% decline for electricity prices in August but there is huge uncertainty around this nowcast.

In any case, the headline monthly CPI indicator, and the monthly trimmed mean measure for that matter, only garner passing attention at best within the RBA. Assistant Governor Hunter reiterated that view last week:

“…in particular, the trimmed mean metric that gets reported in the monthly indicator really isn’t comparable to the quarterly data that we do look at. So we really don’t look at that series. We don’t think that it’s a good read. And what we do use the monthly indicator for though is looking at the individual components, and so they give us a view bottom up on what might be happening at a top level.”

We expect our preferred measure of underlying inflation, which excludes ‘volatiles’, travel & electricity, to have slowed slightly August. Note that the RBA Board has also highlighted the usefulness of this exclusion measure:

“…[t]hey noted that a measure that removes electricity and some other volatile prices from the monthly CPI indicator has had a closer relationship with quarterly trimmed-mean inflation over preceding years than the monthly trimmed-mean indicator.”