Australia’s Q2 CPI is keenly anticipated by RBA watchers given the importance placed upon the full quarterly report by the Governor following the last Board meeting.

Our Q2 CPI preview published on 25 June following the May monthly CPI flagged that underlying inflation in Q2 looks to have been a bit above the RBA’s May SMP forecast - the Governor confirmed that Bank staff arrived at the same view, reiterated in the Board Minutes.

Past the near-term, we also highlighted a risk to the market path for the cash rate is that the disinflationary impulse from the housing components of the CPI are unlikely to be as favourable going forward.

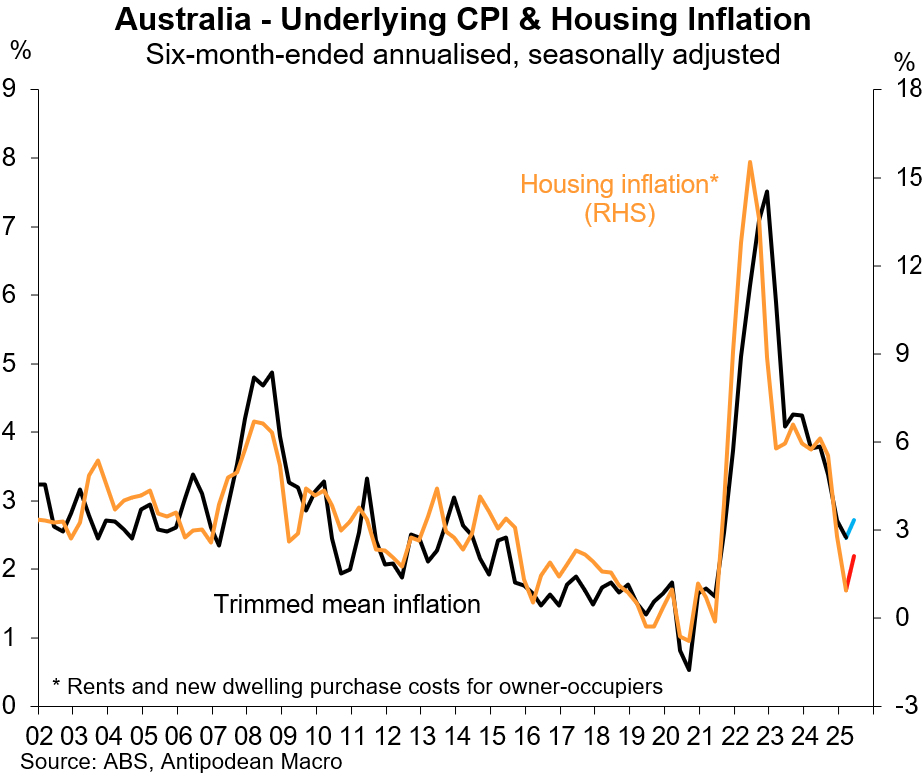

CPI housing inflation and trimmed mean CPI inflation are highly correlated. Significant disinflation in the housing components of the CPI have supported the decline in underlying inflation (see chart).

BUT trimmed mean inflation has only fallen to around the mid-point of the RBA’s 2-3% target even with this substantial CPI housing disinflation.

Below we outline why CPI housing disinflation could be over for now.

This raises the risk that broader underlying inflation could struggle to remain anchored around 2.5% unless other sources of disinflation become stronger.