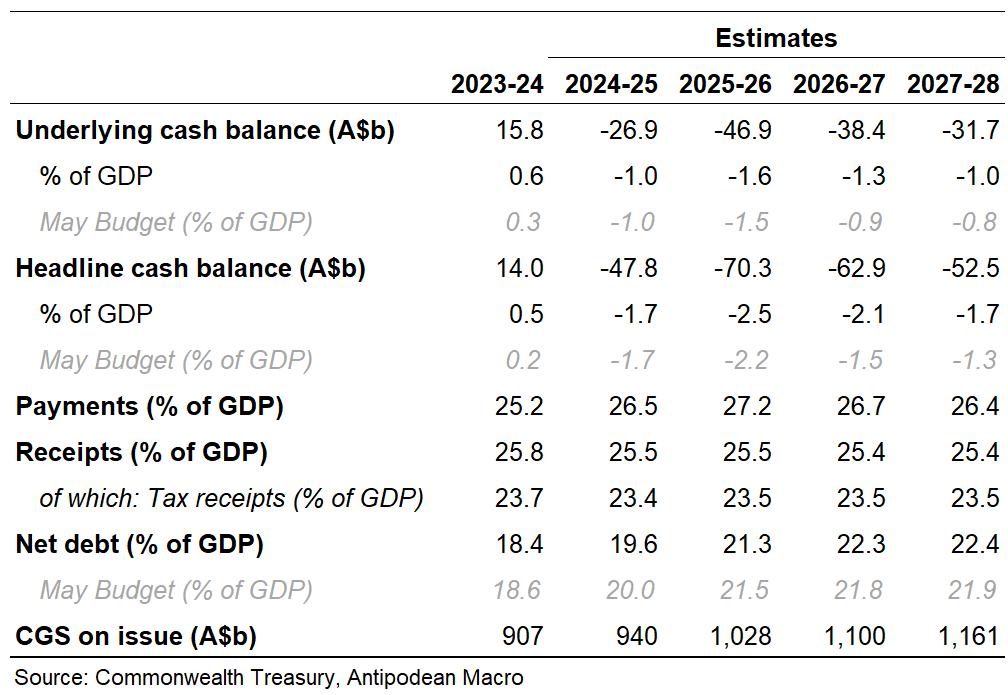

The Australia Government released the Mid-year Economic and Fiscal Outlook (MYEFO) today. It shows larger budget deficits and higher net government debt over the next four years compared with the May Budget outlook.

Despite the best efforts of the Government to sugar coat its fiscal strategy, it is struggling to set the budget on a sustainable path. It’s certainly not a disaster from a global perspective, with net government debt still low.

But policy decisions again worsen the budget outlook even before the inevitable pre-election promises are wheeled out (from both sides). Structural pressures on the budget will only become stronger.

Adding in the latest budgets (or mid-year updates) of the state governments reveals quite the deterioration in Australian government finances at a time when the unemployment rate is at a very low level.

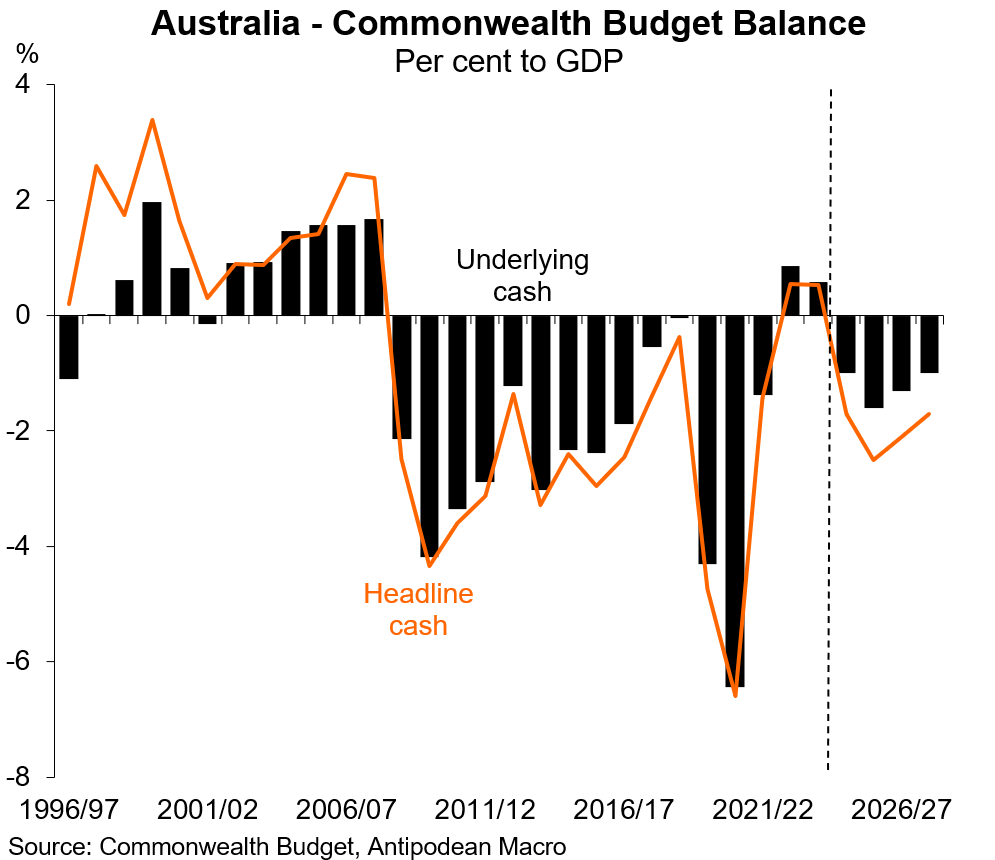

Deficits as far as the eye can see

The Australian Government expects to record an underlying cash budget deficit equivalent to 1% of GDP in the current fiscal year to 30 June 2025. Cumulative budget deficits of $117b (1.3% of GDP) are then pencilled in for the following three years, $23b more than at Budget.

Government borrowing to rise even more

The headline cash budget balance, which adjusts the underlying balance for net cash flows from investments in financial assets for policy purposes, is expected to be much larger than the underlying measure.

Australian governments have found nifty ways to stash spending ‘off balance sheet’ which are excluded from the underlying cash balance. These have risen again at MYEFO (see chart).

But this spending is included in the headline cash balance which, in our view, is again becoming a better measure to assess how much the Government needs to borrow.