The Australia Government released Budget 2025-26 tonight.

This is a Budget that almost never was until Cyclone Alfred reportedly derailed the Government’s plans for an April federal election. As such, a full Budget had to be issued and a May election is expected to be called soon.

With an election looming, the Government is trying its best to keep the outlook for never-ending (structural) budget deficits on the down-low. Their pitch is that it could have been a lot worse.

Not that the Opposition is striving to do much different, with the Shadow finance minister saying that they would “try and get us back to a structural surplus, or structural balanced budget over the medium term”.

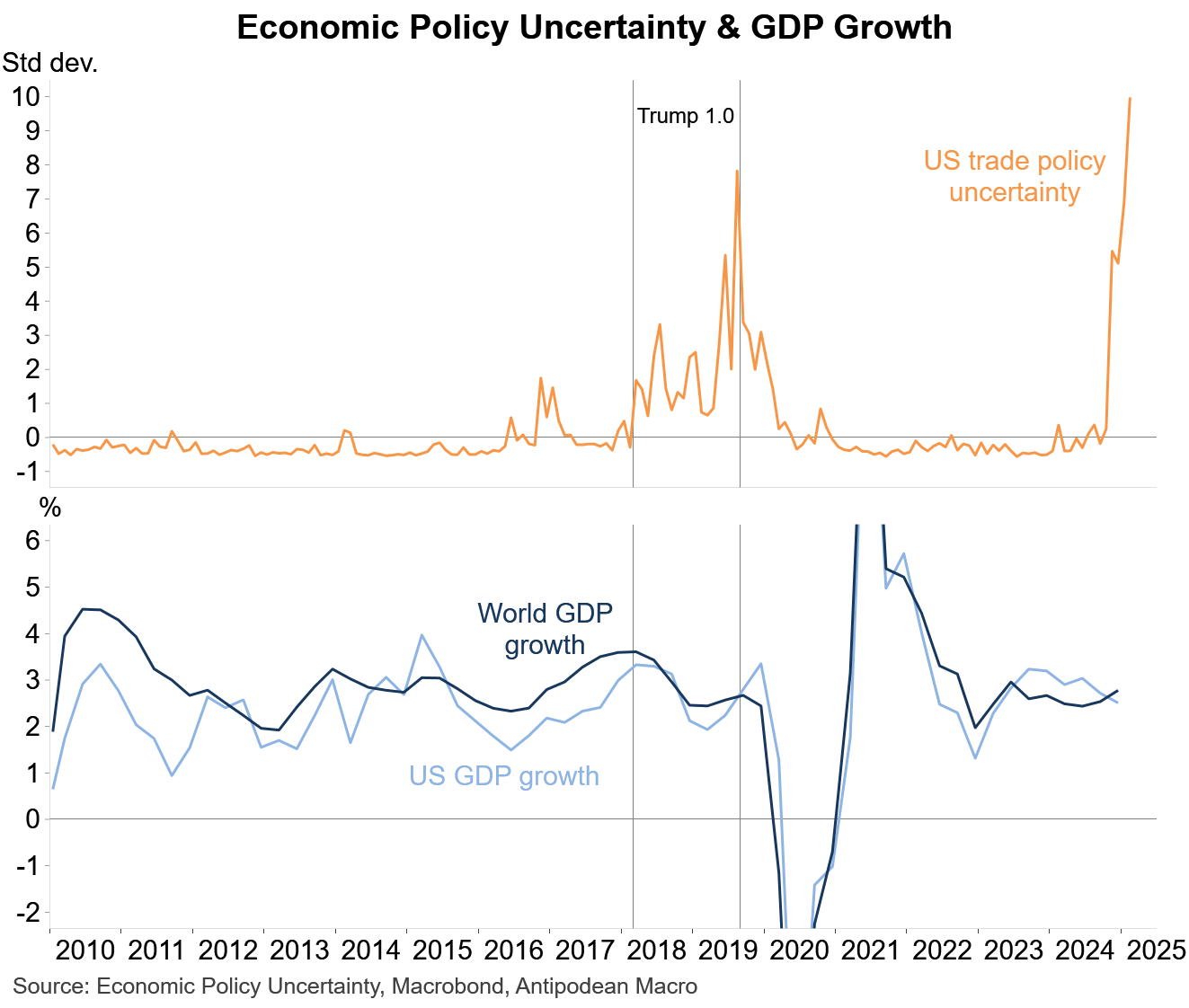

The Budget is being delivered against a backdrop of significant geopolitical and economic uncertainty. Growth in the global economy slowed amid the increase in uncertainty and relatively targeted tariffs of Trump 1.0. The US Administration appears to be significantly more interventionist under Trump 2.0 and accommodating of at least a short-term hit to economic activity.

The focus of the Australian Government in the Budget is firmly on health care and cost of living relief - extended electricity rebates, cheaper medicines, more GP bulk-billing, modest income tax cuts - given focus groups and polls show this is still by far the top issue among voters in Australia.

On the reform front, the Government will ban the use of non-compete clauses for workers earning up to $175,000 annually. These clauses reduce worker mobility and hence their ability to shift into higher-paying jobs.

Otherwise, there is again no hint of any appetite to undertake meaningful policy reform. That’s not just a sleight on the Government (and Opposition), but voters won’t allow it.

For more than 20 years now - arguably longer - voters in Australia have had a "no losers” mentality for any policy changes. That is a by-product of how well-off Australians have become courtesy of an extended period of very high commodity prices and incomes (even allowing for recent real income stagnation).

Aging demographics have also played a role as politicians pander to the growing group of older voters, including by under-taxing superannuation and other wealth.

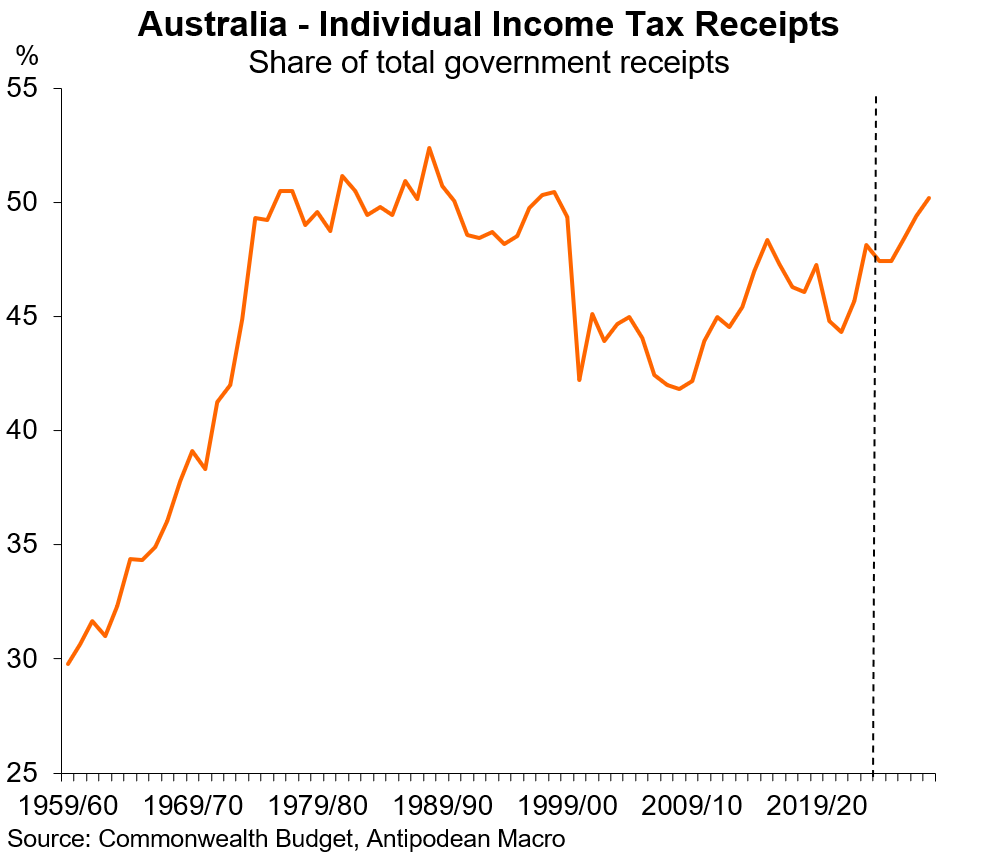

Without meaningful reform, the budget’s reliance on income tax as a source of revenue will only increase further, as it is expected to in tonight’s Budget.

Our fear is that proper tax and other policy reform will only happen when voters are convinced by an economic downturn that reforms are necessary. Better to do it when the sun is shining.

Look over there…

The key fiscal aggregates in the Budget were little changed in the near-term compared with those in MYEFO. From the late 2020s, however, projected budget deficits were revised to be larger and the government debt profile lifted. But that’s in the never never…

In a world of high uncertainty, however, the starting point for net debt of the Australian Government - just ~20% of GDP - is an enviable one.