Australia's money illusion - an update

Terms of trade boom, weak productivity & fiscal largesse

We argue the Australia’s renewed terms of trade boom since 2016 has been an important factor behind both Australia’s weak productivity growth and a creeping lack of fiscal discipline.

Very high commodity prices and the terms of trade are Australia’s Achilles heel.

But forecasting the terms of trade has been a mug’s game for a long time. Even significant weakness in China’s steel-hungry property sector has only put a relatively modest dent in Australia’s terms of trade.

If, and when, the terms of trade do decline, it is clear to us that this will spur much faster productivity growth than what has been the norm recently in Australia.

The problem is that the accompanying weakness in national income would be the PRIMARY issue. Business profitability would decline, necessitating a sharper focus on efficiencies and costs. Governments would be under pressure to curtail spending against an unfamiliar backdrop of downside revenue surprises, making the economic pain worse.

Many private-sector firms have already turned to a focus on costs, with private labour cost growth already slowing noticeably and market-sector labour demand weak. A sharp decline in the terms of trade would lengthen this process. For now, it remains in the risk bucket.

Our analysis is broken down into three parts:

first, we link developments since the early 2000s in Australia’s terms of trade, labour productivity and government spending.

second, we outline fluctuations in labour productivity trends through an industry lens - mining vs non-mining - since the early 2000s.

third, we show that weak labour productivity growth in recent years has been accompanied by weak growth in real (producer) wages. We argue that this has helped to sustain resilient employment growth.

Terms of trade boom 2.0

Australia’s terms of trade - the ratio of export to import prices - is again at a very high level, boosted by high commodity prices. Only Chile matches Australia’s terms of trade boom since the early 2000s.

While Australia’s terms of trade has declined from the record high reached in 2022, it remains only a little below the previous peak set in 2011 which resulted from China’s massive stimulus in response to the Global Financial Crisis. As the effects of that stimulus waned, so did prices for Australia’s key commodity exports and terms of trade for several years thereafter.

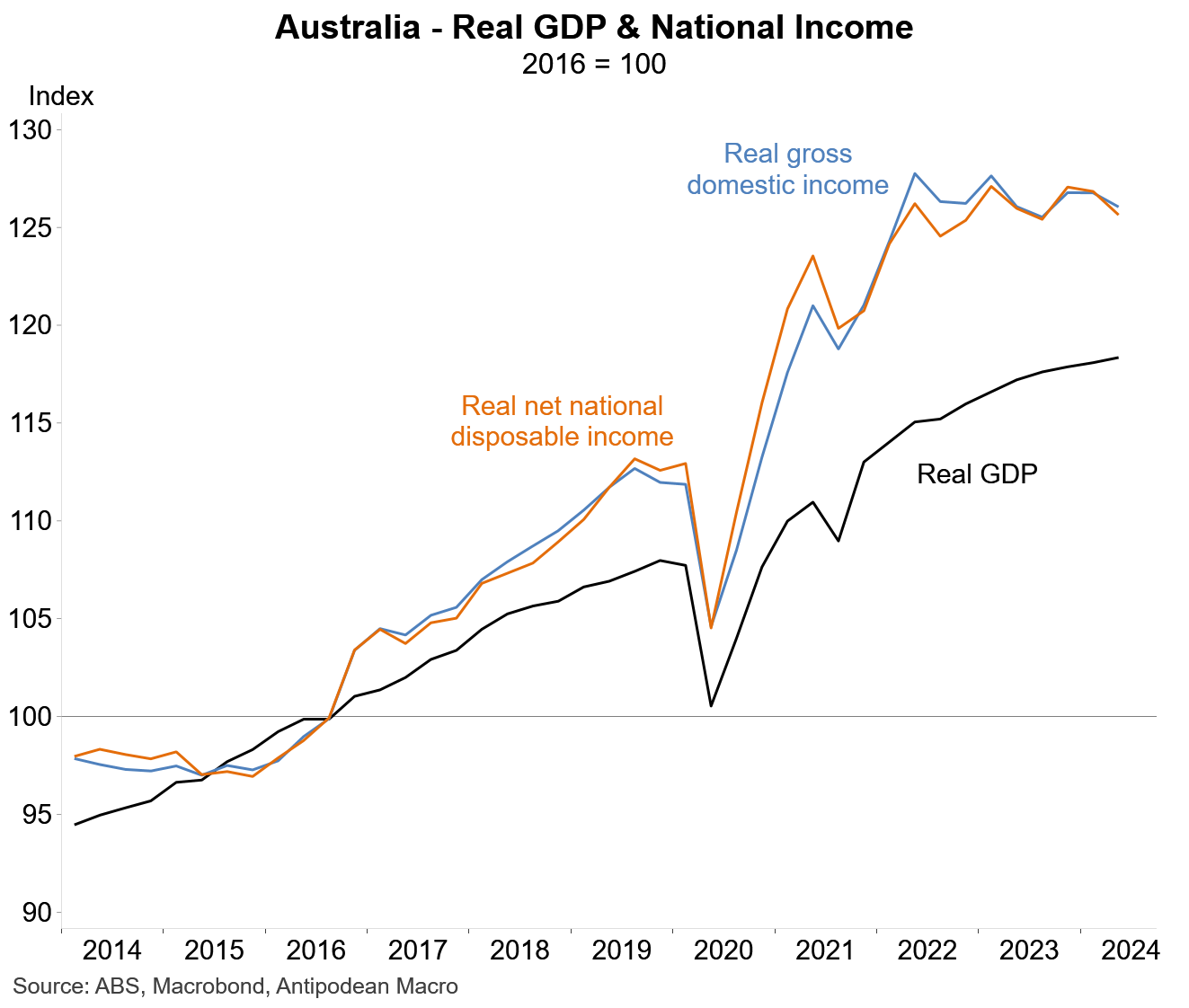

Why does this matter? A high terms of trade increases a country’s collective purchasing power. Measures of Australia’s real national income - as opposed to real GDP - have again benefited from the significant increase in the terms of trade, rising 26% since 2016 compared with just 18% for real GDP.

Disincentivising productivity gains and fiscal discipline

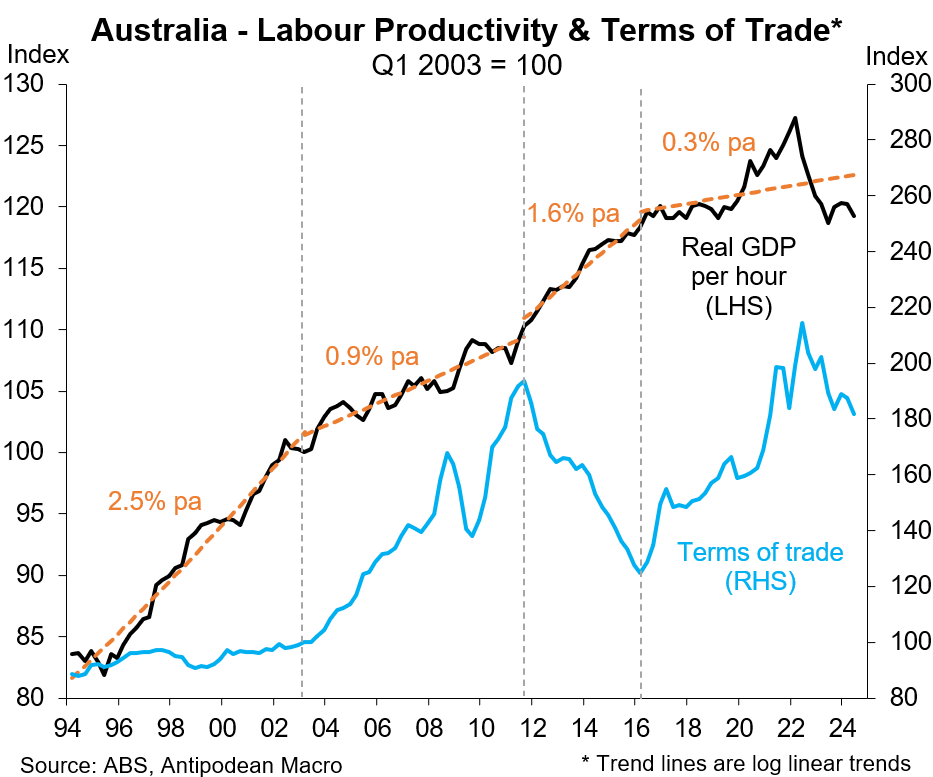

Like during the initial ‘free kick’ to Australia’s real income from 2003 to 2011, the more recent terms of trade boom has again been accompanied by a slowing in Australia’s productivity growth and looser fiscal settings.

While there are many other reasons why productivity growth has slowed in Australia and globally, it is clear in our view that Australian businesses - including in the non-mining sector - have not been strongly incentivised to strive for efficiency gains because of relatively strong growth in income (at least compared with the counterfactual scenario). That ‘free kick’ again.

The 2003-11 terms of trade boom coincided with a sharp slowing in Australia’s labour productivity growth to under 1% per annum, on average. Amid the decline in the terms of trade from 2011 to 2016, average annual productivity growth again strengthened to 1.6%. Since then, productivity growth has weakened significantly alongside the surge in the terms of trade.

Comparing the paths for labour productivity and terms of trade between Australia and the United States is striking.

Australia’s weak productivity performance relative to the United States began at the same time that the terms of trade of each economy went on divergent paths. It would be a huge coincidence if they were not linked.

While Australia’s productivity growth since 2003 has been relatively slow, real national income per capita has outpaced that of the United States. Again, that ‘free kick’ at work from the high and rising terms of trade.

Similarly, Australian governments have not been strongly incentivised to rein in robust government spending amid persistent upside surprises to government revenue growth which has accompanied strong growth in national income.

Government spending has risen significantly as a share of Australia’s economy since the early 2000s - when the terms of trade started rising rapidly - but has increased most strongly since around 2016.

The strong growth in government demand in recent years has been most prominent in health and aged and disability care spending. Some have argued that this can partly explain the weakness in Australia’s productivity growth, as those sectors typically have low labour productivity.

We don’t disagree, but would add that very strong growth in spending on the NDIS, for example, has largely been allowed to happen because there has not been an urgency to really put the brakes on when growth in government revenue has consistently surprised to the upside amid the second leg higher in the terms of trade.

One doesn’t need to go far to see evidence of government profligacy. Cumulative (net) policy decisions made by Australian governments over the past 18 months or so have been significant.

Excluding increases to government investment programs, net policy decisions have been the equivalent of 1.2% of GDP for the fiscal year just ended, and nearly 1.6% of GDP for the coming year. That is significant.