Following the Government’s Budget in May this year, we highlighted that there was little wiggle room for net new policy decisions within the Budget outlook. NZ Treasury also noted at the time that hard choices lie ahead.

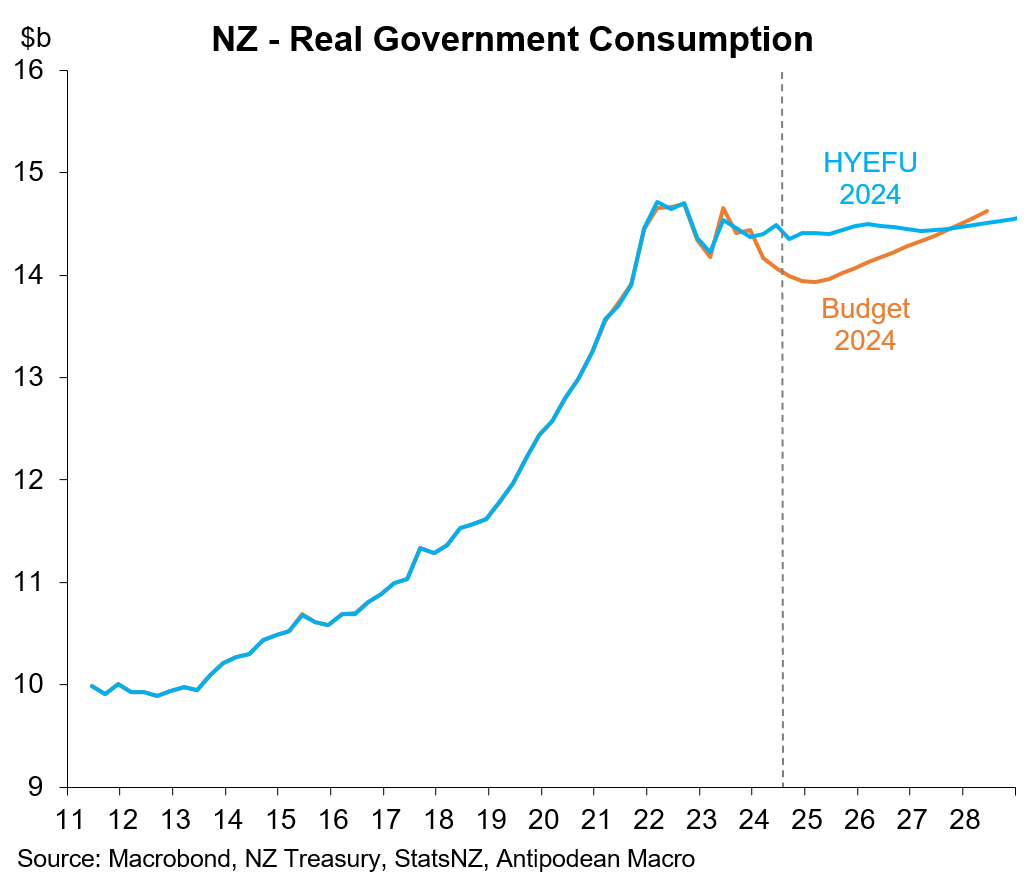

Fast forward to now and the mid-year budget update (HYEFU) shows larger fiscal deficits and higher government debt in coming years. This has largely resulted from the economy being weaker than anticipated by Treasury, notwithstanding that real government consumption not being as weak as previously forecast by Treasury.

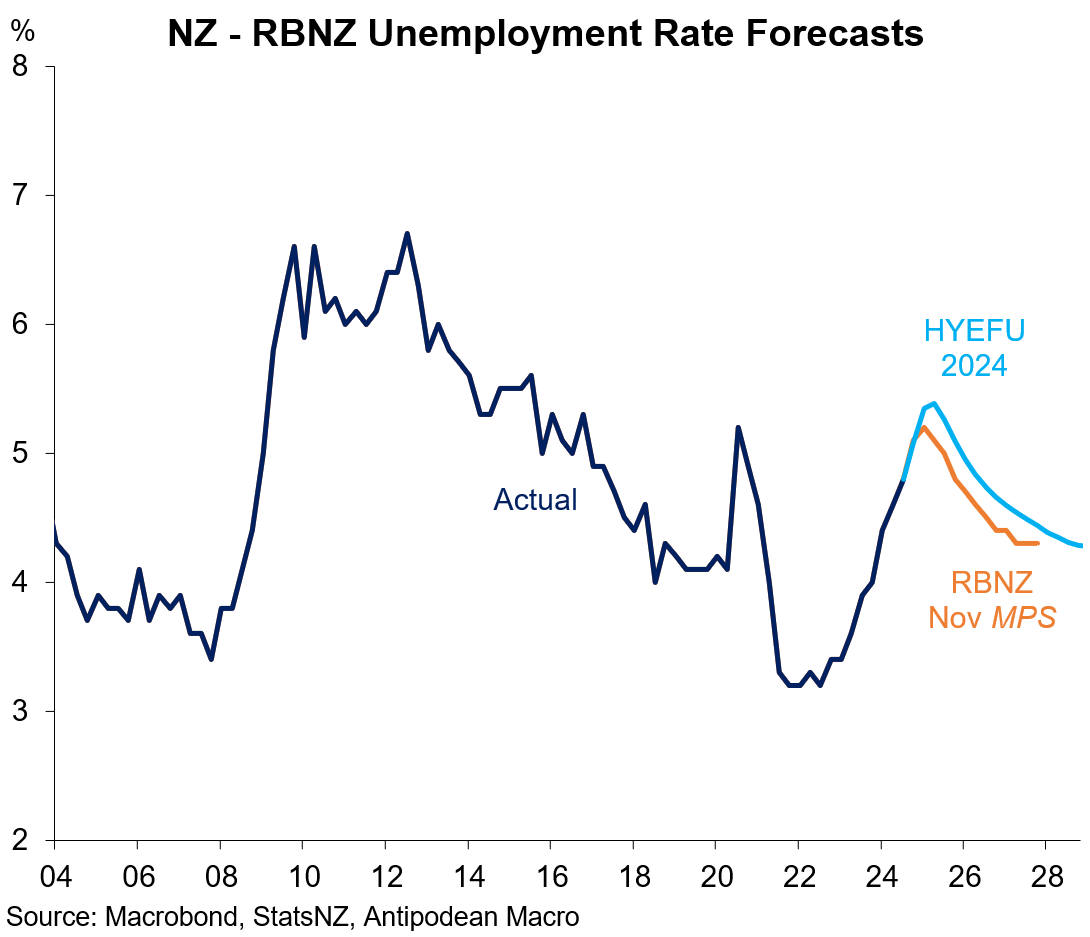

With interest rates falling, Treasury unsurprisingly forecasts a strong pick-up in New Zealand’s GDP growth in 2025-26 and a decline in the unemployment rate, though this follows forecast further deterioration in the near term.

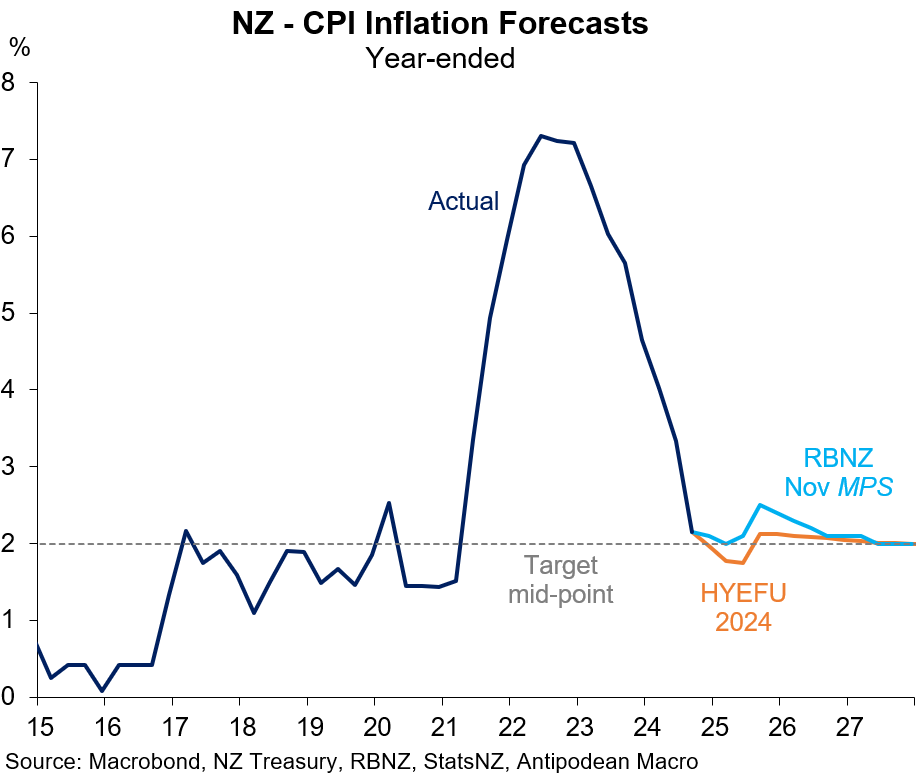

One thing Treasury got mostly right, however, was they anticipated a faster fall in CPI inflation than the RBNZ had forecast earlier this year. The HYEFU forecasts again envisage a weaker headline inflation profile than assumed in the RBNZ’s November MPS.

Budget is in a worse position…

The NZ Government’s budget is in worse shape than thought back at the May Budget.

Measures of the budget balance were in larger deficits last fiscal year than previously forecast and the outlook has also deteriorated.