New Zealand’s Q4 CPI will be released next Wednesday, 22 January.

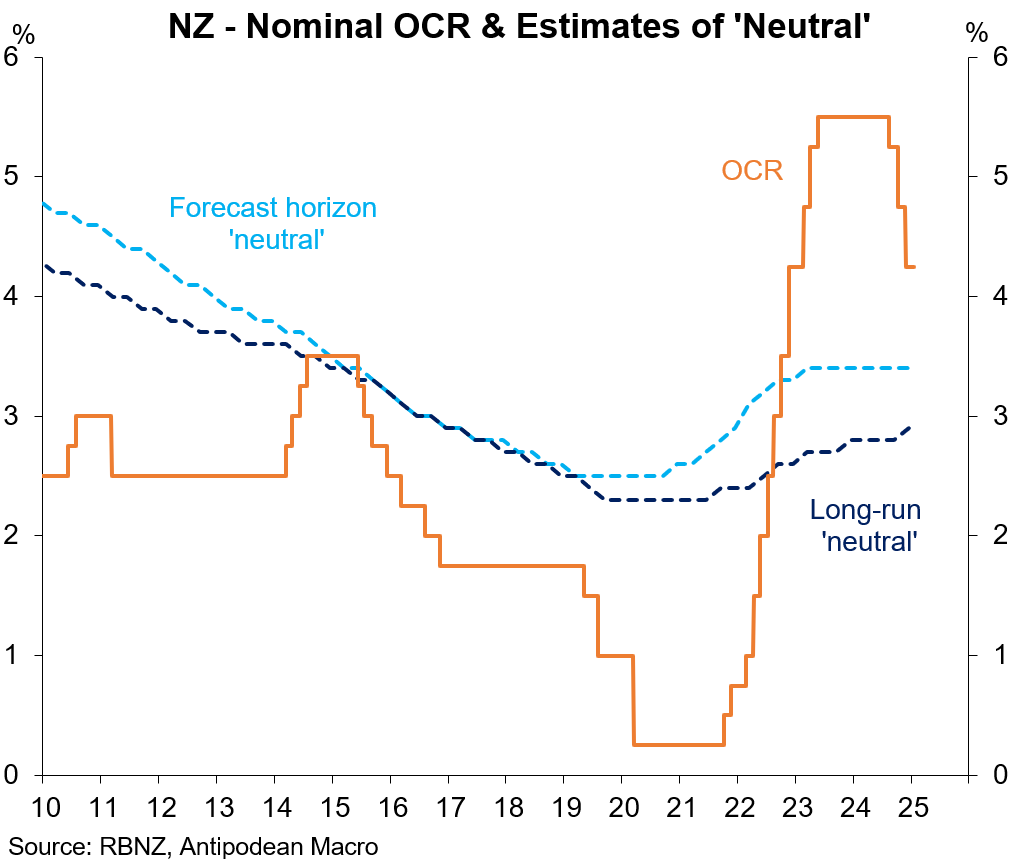

The RBNZ has already lowered the OCR by 125bps but at 4.25% it remains well above estimates of ‘neutral’.

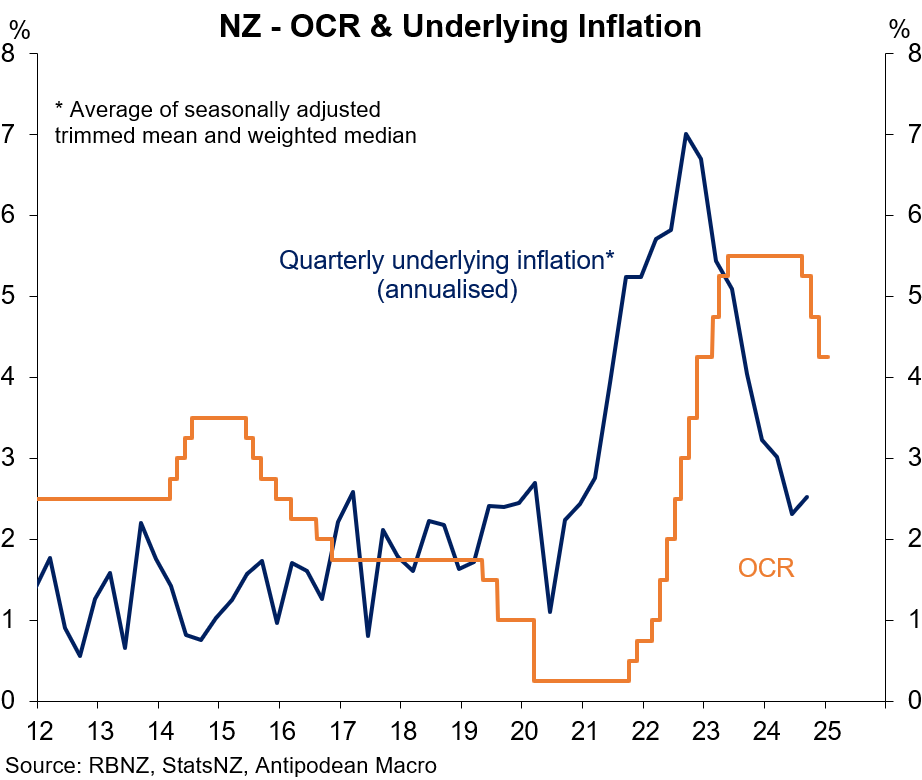

The combination of weak growth, rising unemployment and moderate inflation should be enough for the RBNZ to lop another 50bps off the OCR in February.

Our estimate of (seasonally adjusted) quarterly underlying inflation up to Q3 already supports a lower OCR. We anticipate another ‘comfortable’ outcome for Q4.

While measures of confidence and some outlook indicators have improved sharply, the weak starting point for the New Zealand economy - including sizeable excess capacity - suggests that there is little risk in getting the OCR swiftly back towards estimates of ‘neutral’.

Q4 CPI inflation nowcast

Today’s release of monthly price data for December allowed Q4 inflation forecasts to be firmed up. The monthly price indicators (excluding rents) cover ~35% of New Zealand’s CPI, with around half accounted for by food. The monthly rents data provide some insight to the quarterly CPI rents measure (9.5% weight).