The RBA Board meets today and tomorrow and Governor Bullock will give a press conference tomorrow afternoon. Deputy Governor Hauser will also speak at the annual ABE dinner on Wednesday evening.

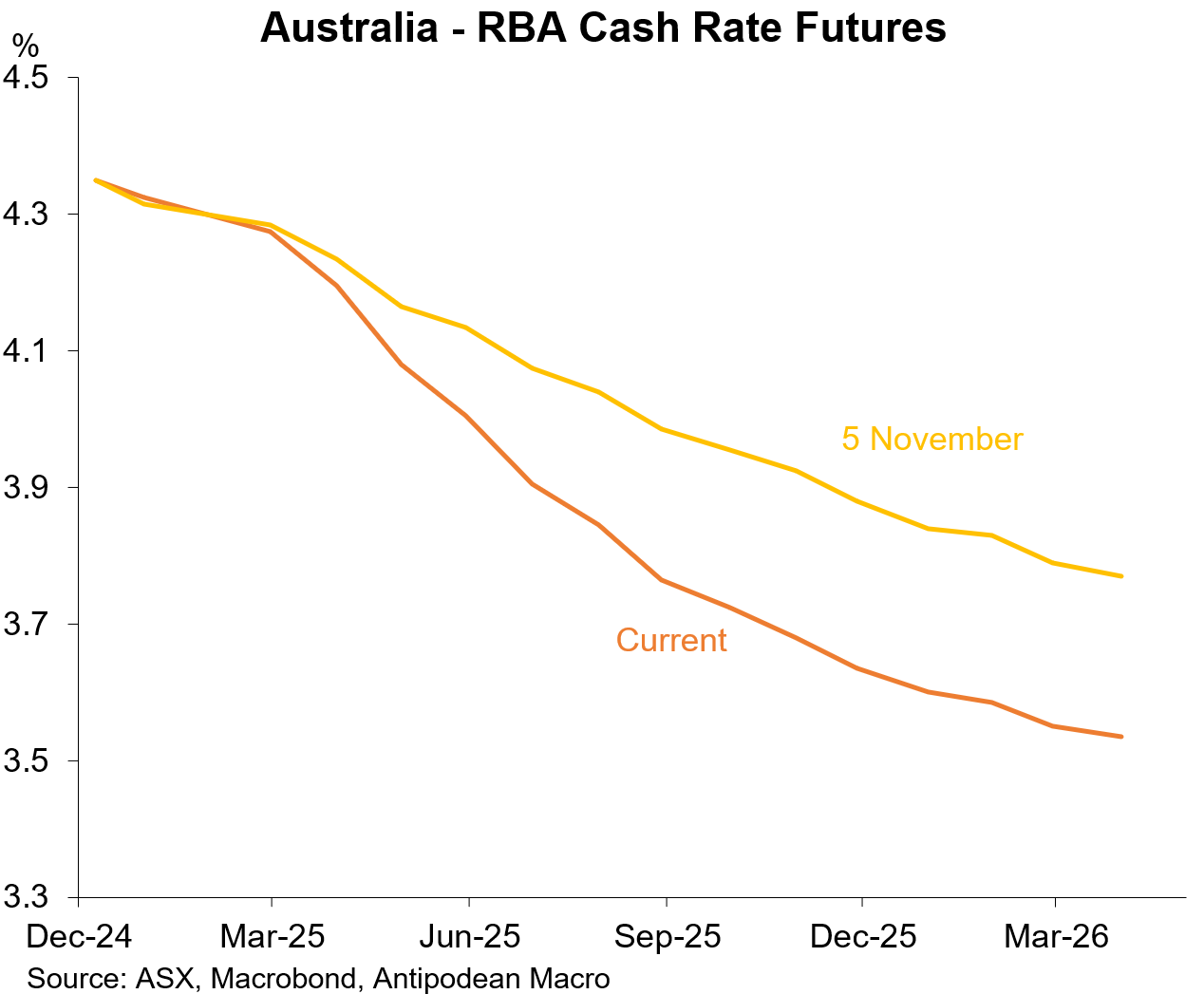

While no-one expects the cash rate to budge tomorrow, market pricing for the cash rate has shifted lower since the early-November Board meeting. A 25bp cut is now expected by the April Board meeting.

Our view is that new information over the past month is unlikely to have changed the Board’s thinking. Moreover, by the next Board meeting on 17-18 February there will important new inflation on inflation (Q4 CPI), labour market conditions and political/fiscal updates.

Alongside a set of new forecasts and following a 2-month break between meetings, the February Board meeting looms as a much larger opportunity to change tune if the facts suggest it.

The recent data pulse hasn’t changed the story

Since early November we have received several updates on the Australian economy, notably October labour force, October monthly CPI and Q3 GDP.

How will the Bank characterise the Q3 GDP data?

There was a lot of negative reporting and commentary regarding the Q3 GDP release which showed the economy grew just +0.3% q/q.

We suspect the Bank will have taken a much more benign view.

Yes, it was another weak outcome, but it was just 0.1ppts shy of the Bank’s November SMP forecast. While year-ended GDP growth of 0.8% was 0.2ppts below the Bank’s forecast, this ‘miss’ also partly reflected revisions.

Importantly, those GDP revisions also showed that the Q2 starting point for activity was higher than previously thought (+0.2% for GDP and +0.5% for domestic demand). Therefore the Bank’s models would suggest that the economy is operating even further above capacity - albeit slightly - than previously thought (i.e. the output gap is marginally more positive than previously estimated).

While this is splitting hairs, you wouldn’t have read about it amongst all the doom and gloom commentary.