Cautious.

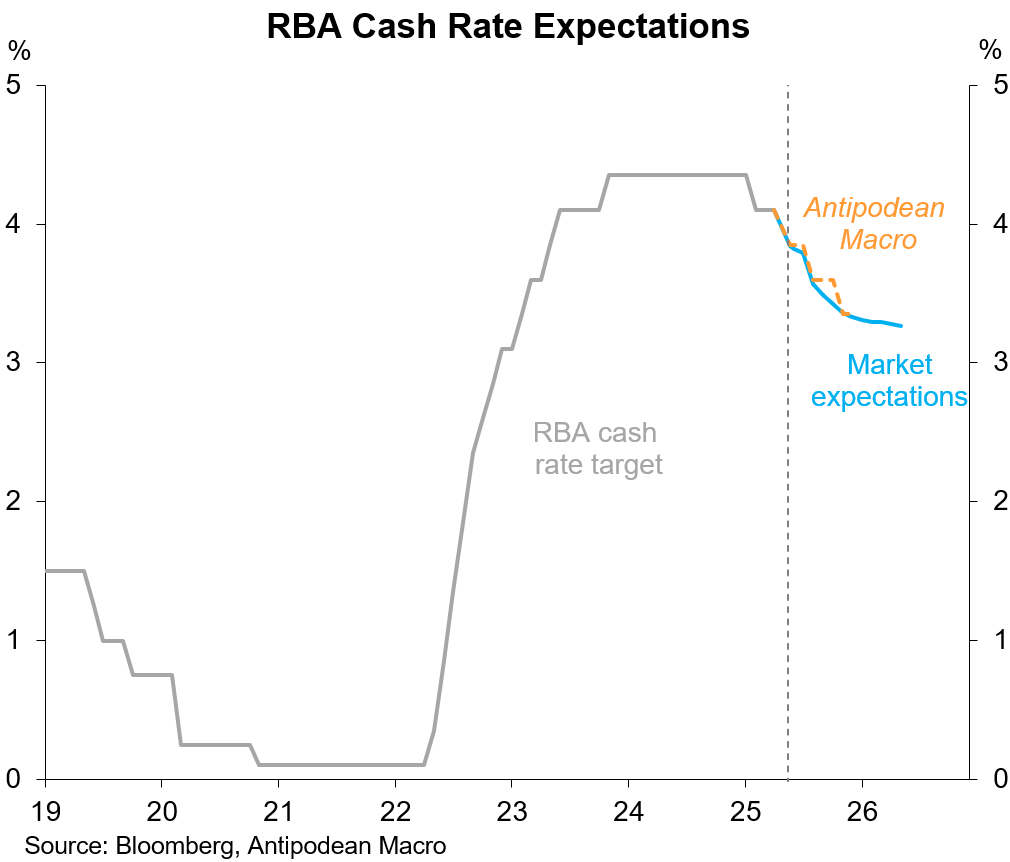

We expect the RBA Board to cut the cash rate by 25bps next Tuesday but to again emphasise that it is taking a cautious approach to future policy decisions.

A rate cut is likely to be sold as another modest reduction in the restrictiveness of monetary policy, but that the stance of policy nonetheless remains restrictive.

The Board’s communication is likely to echo that of the Bank of England a week ago. That is, monetary policy is not on a pre-set path, and while there has been continued progress in disinflation risks remain in both directions.

The April Board Minutes highlighted “the need to be cautious and alert to the evolving economic outlook, and the importance of future decisions being guided by the incoming information and the assessment of risks”.

The whip-sawing in global trade policies and financial markets since early April and ongoing uncertainty about how the trade situation plays out will have made for fruitful internal Bank discussions about the best way to frame their forecasts and narrative.