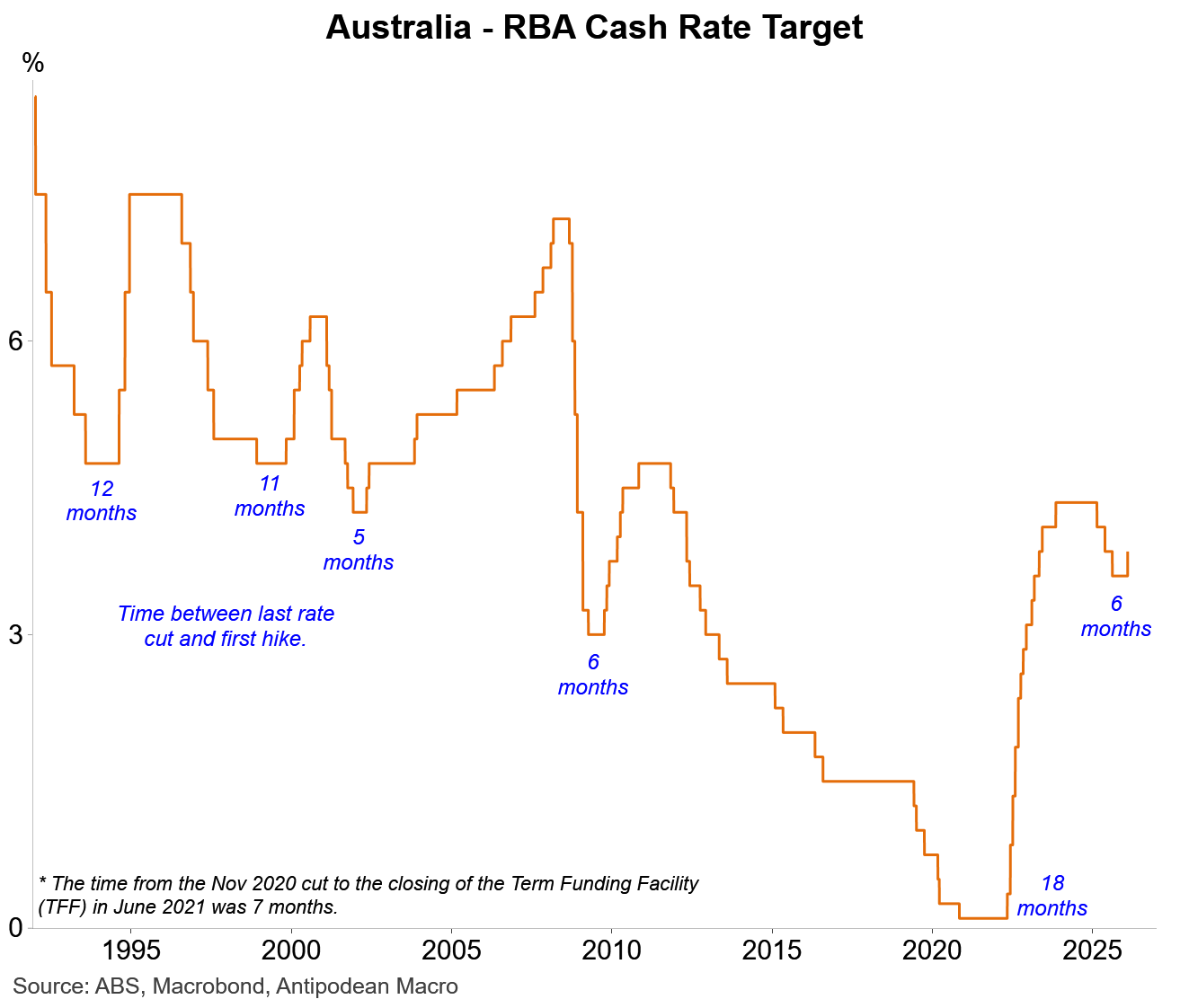

The RBA Monetary Policy Board raised the cash rate to 3.85% today as widely anticipated, including by us. The time between the last cut and today’s hike is 6 months which is within the range of timeframes seen in the past in Australia (see chart).

The decision was unanimous, including Treasury Secretary Wilkinson voting for the hike - a surprise to some commentators.

While no Australian government likes interest rates going up, with the next federal election due by mid-2028 we suspect the Government won’t make too much noise about today’s hike. It will hope that the macro backdrop remains sound and tighter policy takes care of higher inflation by 2028 given voter concerns about the cost of living. In the meantime we expect the Treasurer to continue to reference the “independent” RBA…

The Board’s statement, accompanying Statement and increases to the underlying inflation outlook are unequivocally hawkish.

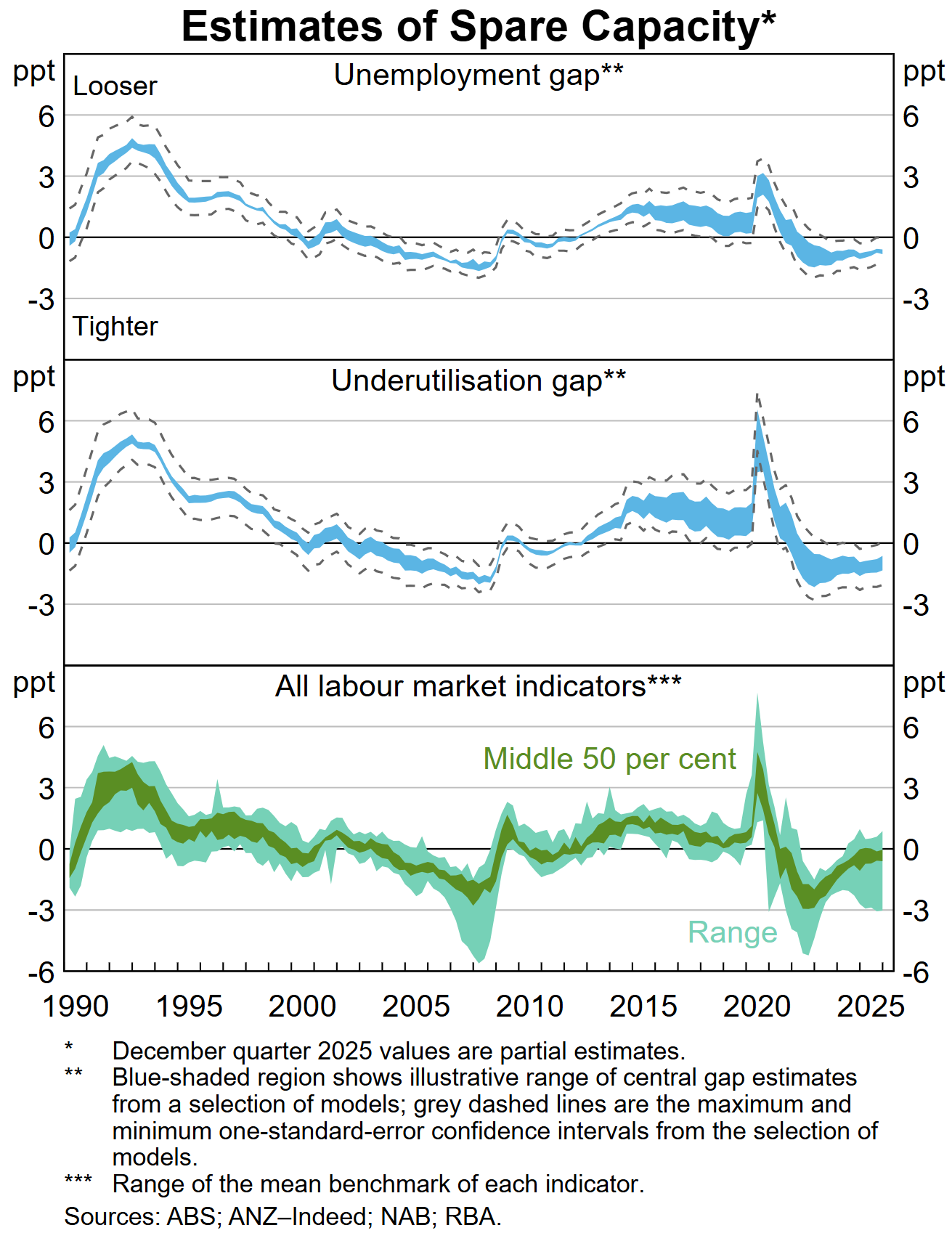

Tellingly, the first key risk to the forecasts identified in the SMP is that the “central projection may place too much weight on the role of temporary factors in driving recent inflation outcomes”. In other words, the Bank is worried that capacity pressures may have been playing a larger role than assumed in the stronger inflation outcomes in H2 2025.

The pick-up in (private) demand growth over H2 2025 has been much faster than the Bank expected and - as the Governor and SMP noted today - the Bank/Board has underestimated the degree of excess demand in the economy. As a result, the labour market has been more resilient, and inflation higher, than expected.

Our summary: the Board got fed up waiting for inflation to return towards the mid-point of the target and is, for now, more worried about upside risks to the inflation outlook.