We expect RBA Governor Bullock to play a fairly straight bat at tomorrow’s press conference following the release of the RBA Board’s statement.

The monthly CPI indicator for May released on 26 June is key. Why? The monthly CPIs for the initial two months of the quarter have enabled us to compile accurate nowcasts for the full quarterly CPI - including on a trimmed mean basis - in recent quarters.

Global developments

Despite the Governor being clear that the Board isn’t ruling anything in or out, she is likely to be pressed by journalists about the potential timing of future policy easing given the Bank of Canada, ECB, Riksbank and SNB have all delivered one policy rate cut.

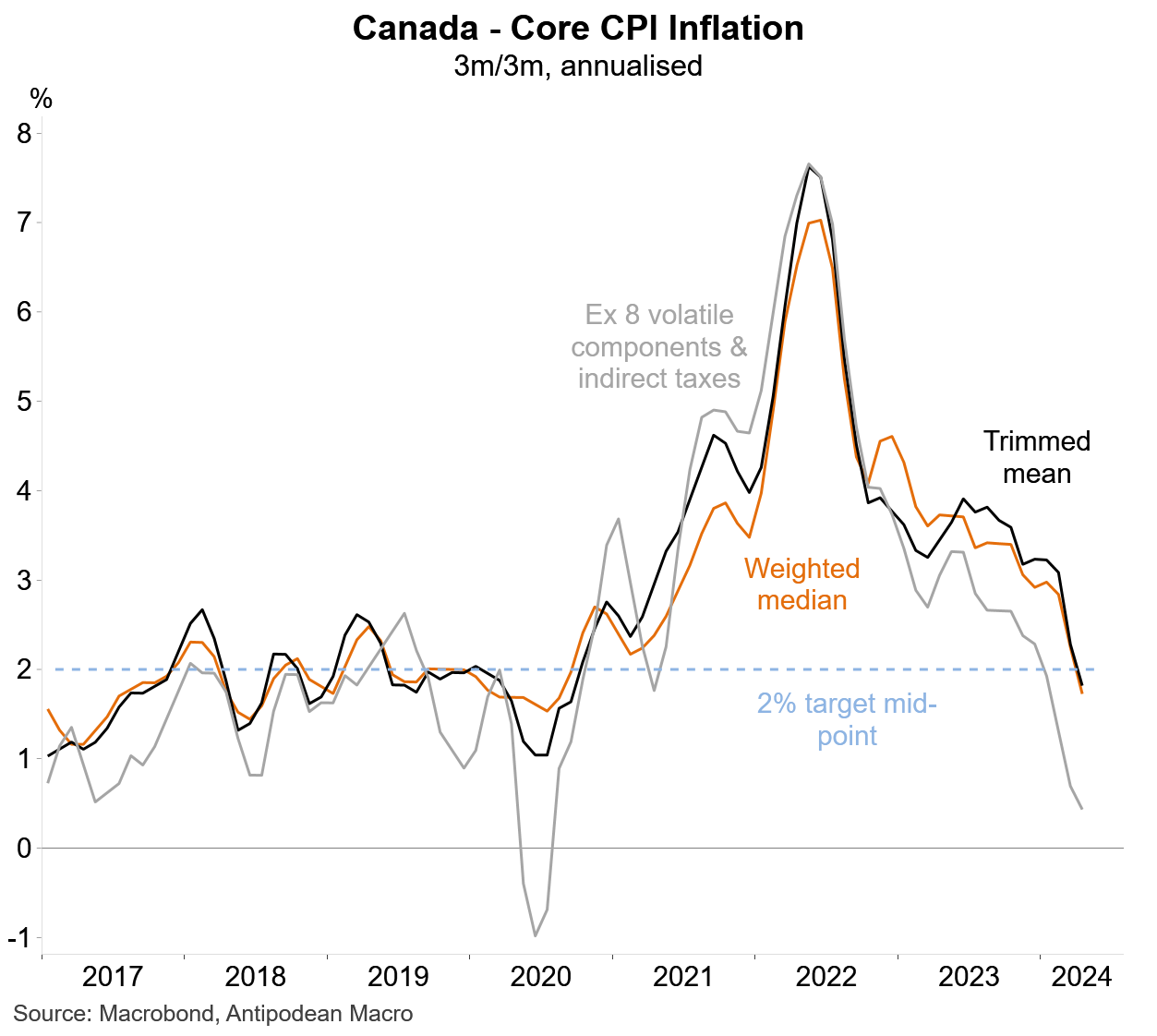

The Governor can point out that the ECB and BoC both tightened by more than the RBA, and can point to the significant decline in ‘core’ inflation and rising unemployment in Canada, and Sweden (explaining the ECB cut is more difficult though).

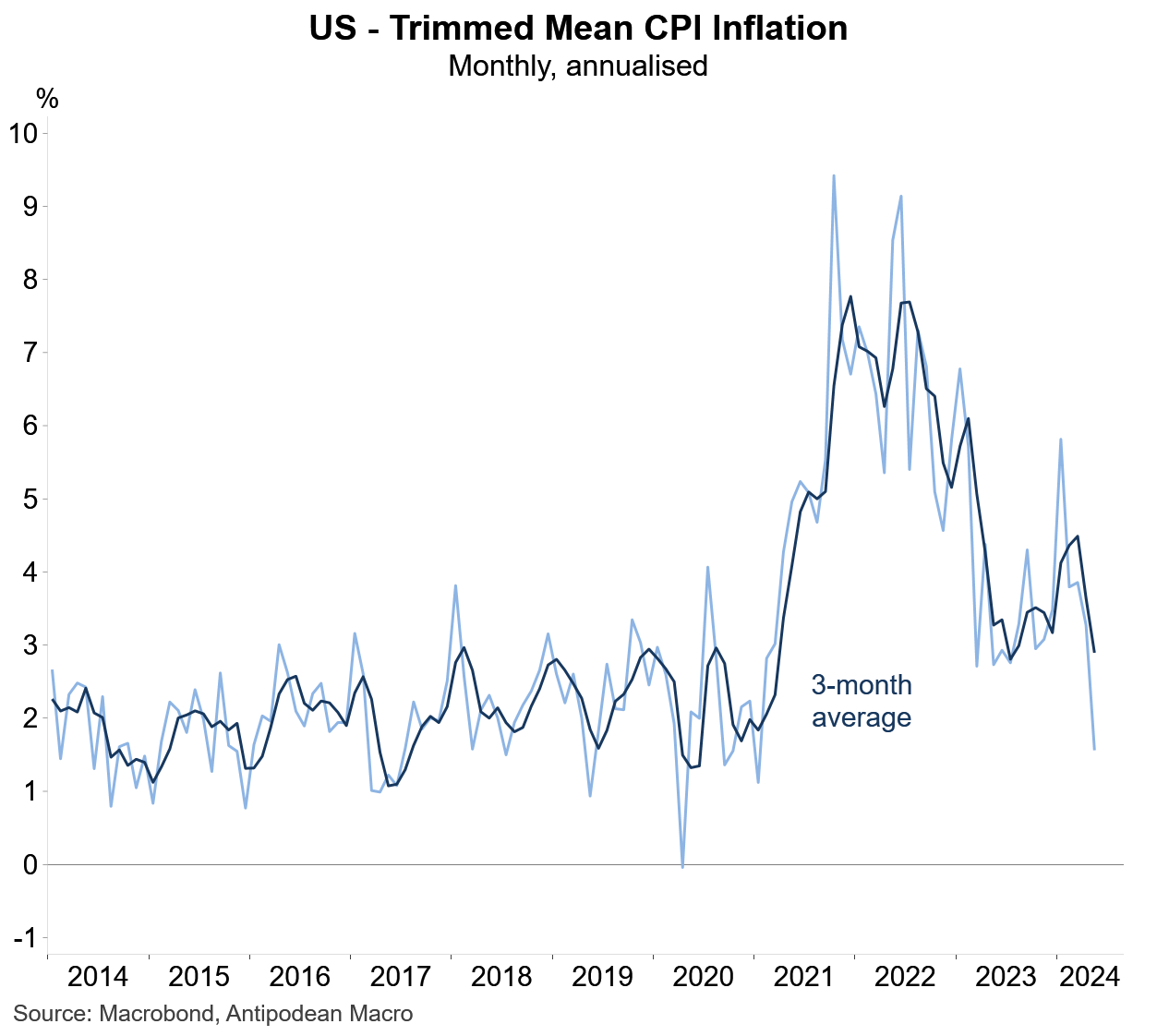

The recent soft US CPI (and PPI) inflation data for May may have also renewed the Bank’s confidence that the global disinflation process remains broadly on track.

Domestic developments haven’t changed the narrative

Domestically, new information received since the 6-7 May Board meeting isn’t likely to have changed the Bank’s overall narrative in our view. The Board will continue to not rule anything in, or out.